ev tax credit bill point of sale

The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. The credit is now refundable and can be remitted to the dealer at the point of sale.

Volkswagen ID4 electric vehicle Josh LefkowitzGetty Images Understanding the 7500 federal EV tax credit.

. At up to 12500 heres how the two versions compare. Hellers bill lifts the individual manufacturer cap but would phase out the credit for the entire industry in 2022. Current EV tax credits top out at 7500.

The BBB legislation being discussed starts Jan 1 2022 and is not retroactive. At the time the law stated that the value of the credit was equal to. Heres how you would qualify for the maximum credit.

The tax credit was passed in a 2009 bill and still applies to 2010 and newer plug-in electric vehicles. Youll get an additional 3500 off if the EV has a battery of at least 40kWh. Theres a 4000 base amount tax credit for all EVs.

The Tax Credit in proposed BBB legislation is transferrable to the dealer effectively making it point of sale. Youll get an additional 3500 off if the ev has a battery of at least 40kwh. Be a controversial point that might change by the time the.

Thats pushed General Motors and Tesla out of the. For five years the legislation would implement 7500 point-of-sale consumer rebates for electric vehicles and pay out an additional. A point of sale rebate will do nothing for the consumer and just increase prices by 80 of the credit amount thus just lining the dealerships pockets with.

Youll get an additional 3500 off if the ev has a battery of at least 40kwh. Biden proposing point-of-sale incentives affordable EVs made in America. 4500 if the final assembly occurs at a domestic unionized plant.

Heres how it works. Last week Tesla said orders for cars placed by Monday would be eligible for a full federal tax credit of 7500 and these customers will get their cars delivered by the end of the year. Tesla said in July it had hit the 200000 vehicle threshold which under law.

An expansion of the EV tax credit which has seen bipartisan support before. 500 if at least 50 of components and battery cells are manufactured in the US. However Biden wants it to be either point-of-sale rebate or able to spread the tax credit out over 5 years.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Currently electric vehicle buyers can qualify for a 7500 tax credit only for manufacturers that have sold fewer than 200000 total EVs. But that could change.

The change would move the tax credit much closer to a point-of-sale incentive and with the right qualifying EV buyers could receive a max of 12500 back from the government for buying a battery. This reduces the total cost of purchasing a new EV with the added bonus of reducing how much interest youll pay over the life of your car loan functioning similarly to a down payment. Bengt Halvorson May 18 2021 109 Comments.

But the true perceived slight was the new reform to the federal EV tax credit. On Tuesday at an event previewing the fully electric Ford F-150 Lightning. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022.

New EV credit that is the sum of. If 24 billion can take 7500 off the price of a car with a tax credit imagine what 100 billion could do to subsidize an EV at the point of. The version of the EV tax credit that passed the senate committee a month ago wasnt a point-of-sale rebate it was still just a tax credit as it currently stands.

Many major automakers promote the 7500 EV tax credit on their website. 3500 if the EV has a battery of at least 40kWh. General motors stated that they hoped the president and congress would evaluate the tax credit for evs saying that tax credit of 7500 is.

Ev tax credit bill point of sale. For five years the legislation would implement 7500 point-of-sale consumer rebates for electric vehicles and pay out an additional. Like leasing an EV buying a used electric auto also does not allow you to claim the traditional EV tax credit.

Just slightly changed numbers. But truth be told that tax credit doesnt actually apply to the sticker price of an electric car. In order to claim these tax credits you have to do the heavy lifting and write them off on.

Where EV tax credits come into play at tax time point-of-sale rebate programs translate to immediate savings upon purchasing a new electric vehicle. EV tax credit boost. I could see maybe 2500 being point of sale and then the remainder 7k or 75k being a tax credit.

The initial EV tax credit was passed under the Energy Improvement and Extension Act of 2008. Not specified if retroactive is misleading. How this will actually work or If this requires buy-in from the dealer is unknown.

You Dont Get the Tax Credit Right Away.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Oil Industry Cons About The Ev Tax Credit Nrdc

Plug In Electric Vehicle Policy Center For American Progress

Democrats Unveil New Ev Tax Credit Proposal Transport Topics

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Is House Ev Tax Credit Proposal Targeting Tesla Huge Increase For Unions

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Plug In Electric Vehicle Policy Center For American Progress

Latest On Tesla Ev Tax Credit March 2022

Southern California Edison Incentives

Oil Industry Cons About The Ev Tax Credit Nrdc

How Do Electric Car Tax Credits Work Kelley Blue Book

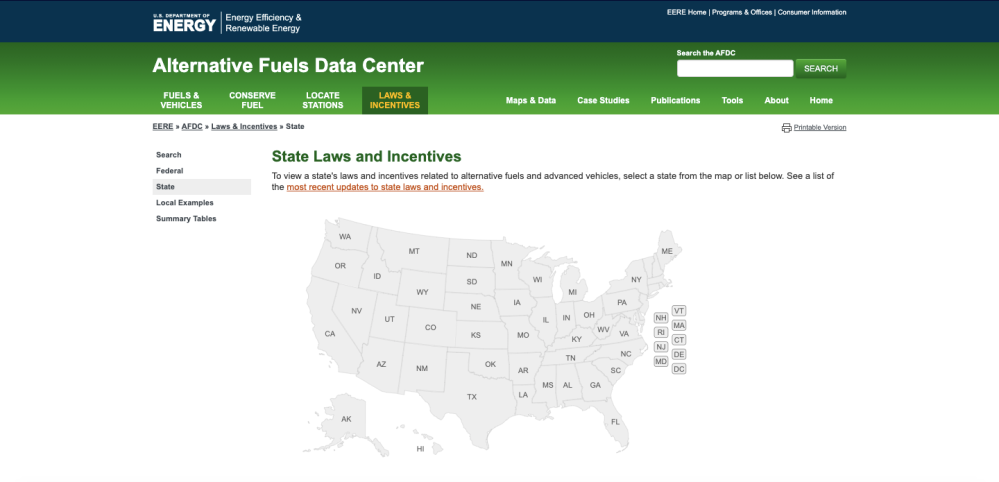

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Incentives Ev Savings Calculator Pg E

Oil Industry Cons About The Ev Tax Credit Nrdc

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

How Electric Vehicle Tax Credits Work

Ev Tax Credit Plan Draws Ire From Non Union Toyota Tesla Bloomberg